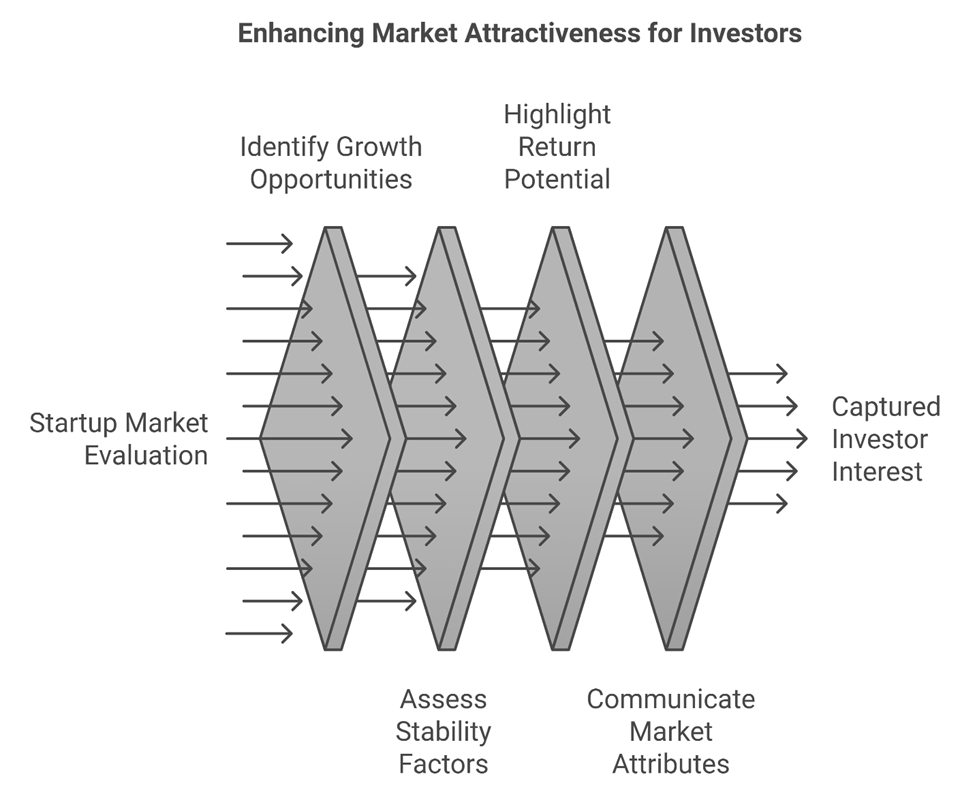

Why Market Attractiveness Matters to Investors

In the MENA region, investors are increasingly drawn to startups, yet competition for funding remains fierce. Investors evaluate startups based on the market potential as much as the product itself; an attractive market represents opportunities for growth, stability, and returns on investment. This paper explores key factors investors seek in a market, empowering MENA founders to assess and present these attributes effectively.

This paper will guide founders through understanding, quantifying, and communicating the attractiveness of their market—so they can capture investor interest and propel their ventures forward.

Defining Market Size and Relevance: TAM, SAM, and SOM

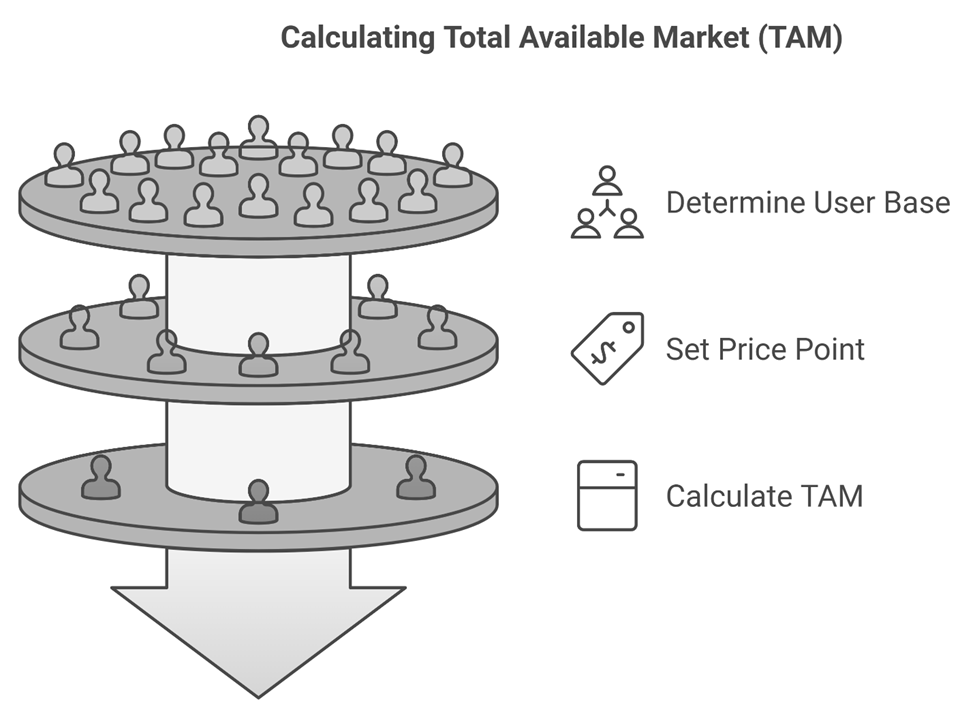

A. Total Available Market (TAM): The Big Picture

TAM represents the total revenue opportunity available if every potential customer purchased your product or service. It provides a broad overview of the market’s potential size, offering insight into the total revenue pool for the industry.

Ex: Imagine a startup developing ride-hailing services in the MENA region. The TAM might be represented by the entire transportation market revenue in all MENA countries, including public and private transport options. While TAM offers a “big number” to impress investors, it also shows the market’s full reach potential under ideal conditions.

How to Calculate TAM:

To determine TAM, consider the entire user base and the potential product or service price. Use the formula:

TAM = Total Number of Potential Customers × Price of Product/Service

For example, if 100 million people in MENA would theoretically use a ride-hailing service, and the annual price per user is $300, the TAM would be $30 billion.

B. Serviceable Available Market (SAM): The Reachable Market

SAM narrows the TAM down to the portion of the market your startup can realistically serve, considering factors like geographic, demographic, or regulatory constraints.

Ex: Continuing with the ride-hailing example, SAM could represent the transportation market within specific MENA cities where the service is available, such as Riyadh, Dubai, and Cairo. This is still a substantial figure but more realistic than TAM.

How to Calculate SAM

Start with your TAM, then adjust based on specific criteria that make the market feasible to enter, such as the population in operational cities or users in certain income brackets. If our ride-hailing startup can access only 20% of MENA’s transportation market, SAM would be 20% of $30 billion, or $6 billion.

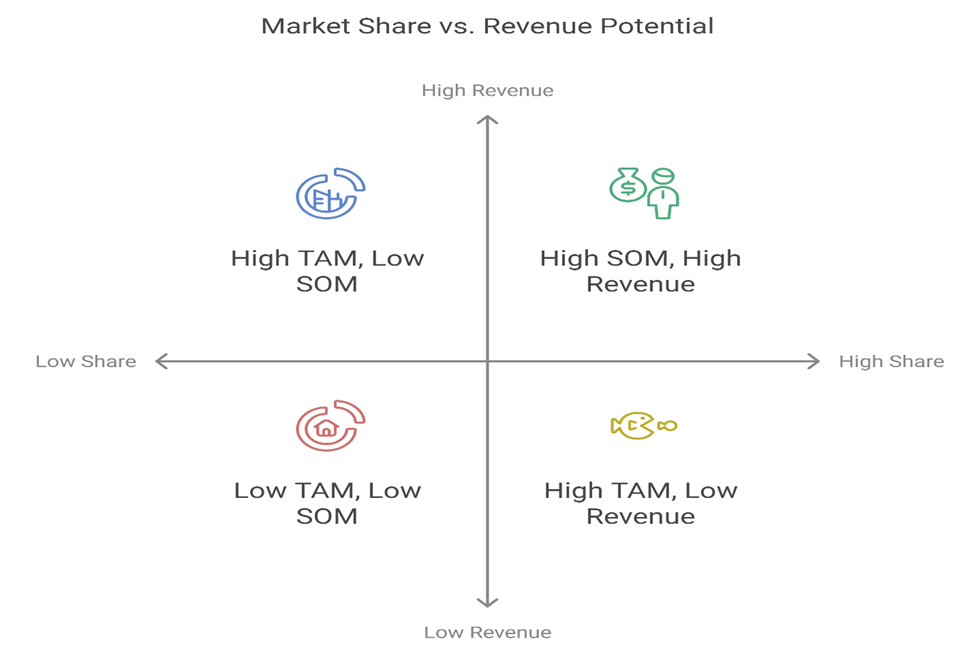

C. Serviceable Obtainable Market (SOM): The Immediate Market

SOM is the realistic revenue you can capture in the near term, typically during initial market penetration. It’s the share of SAM that the company believes it can secure, factoring in competition and brand positioning.

Ex: For the ride-hailing service, SOM would be the percentage of customers the startup anticipates acquiring in its target cities, say 10% of SAM in the first few years.

How to Calculate SOM

Multiply SAM by the expected share of market capture. If the startup expects a 10% market share in its SAM, then SOM would be $600 million (10% of $6 billion).

Why These Metrics Matter

Investors value these layered insights because they show a path from broader market potential down to immediate, tangible revenue goals. TAM, SAM, and SOM together allow investors to envision the scalability of the startup’s business model and the founder’s understanding of the market.

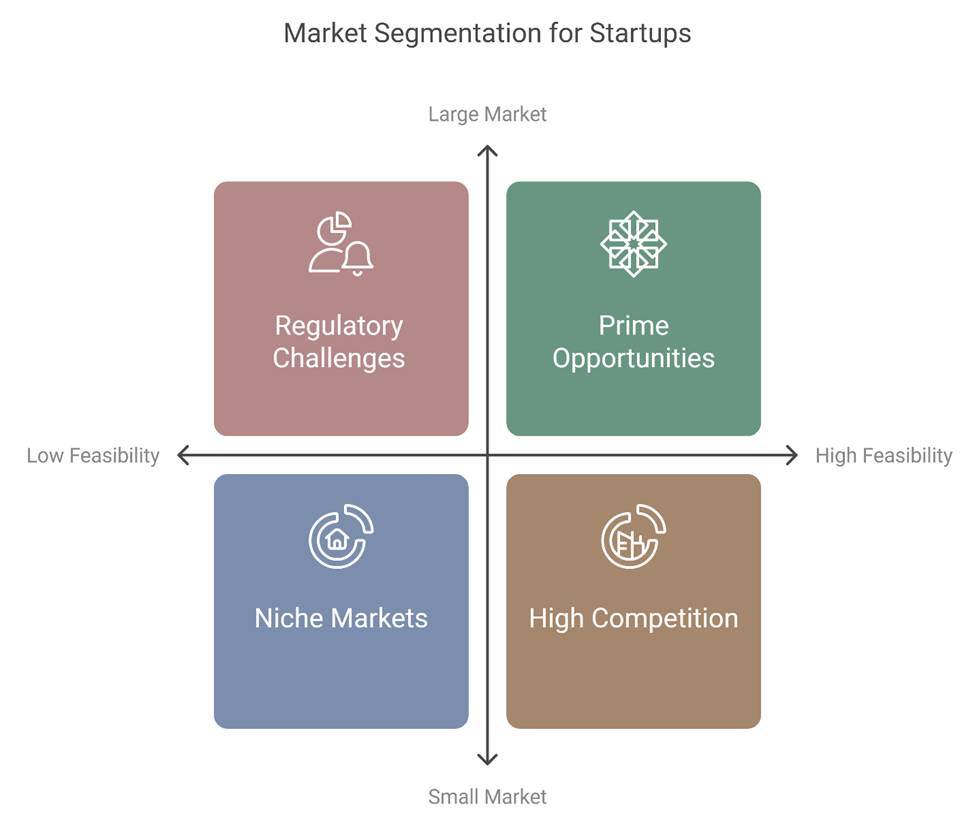

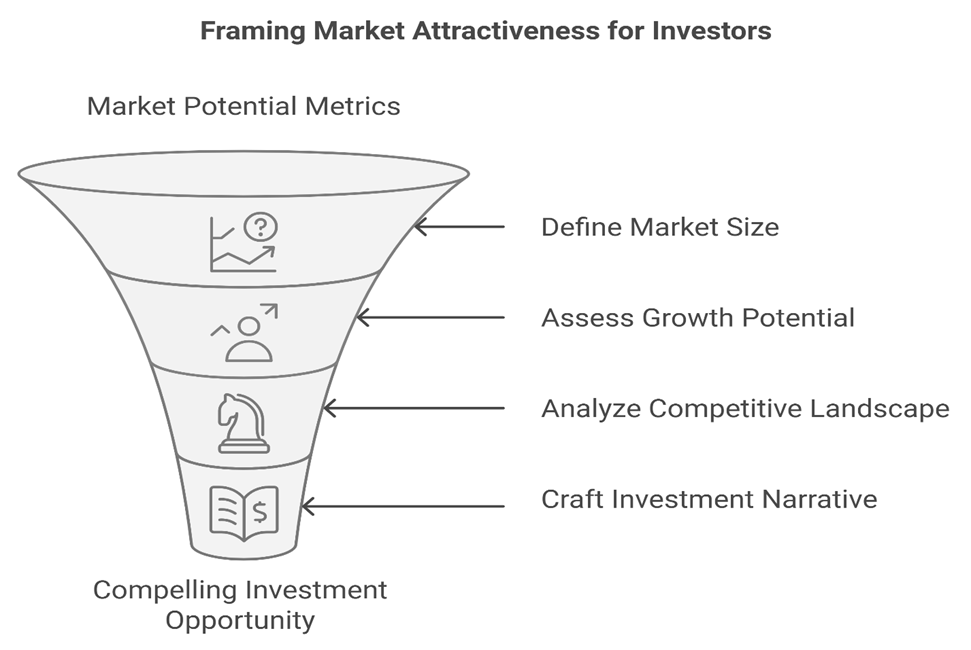

Beyond Size: Core Components of an Attractive Market

While market size is foundational, it alone is not enough. Investors seek markets that are not only large but also exhibit favorable growth dynamics, manageable competition, and accessible channels.

A. Growth Potential and Adoption Rates

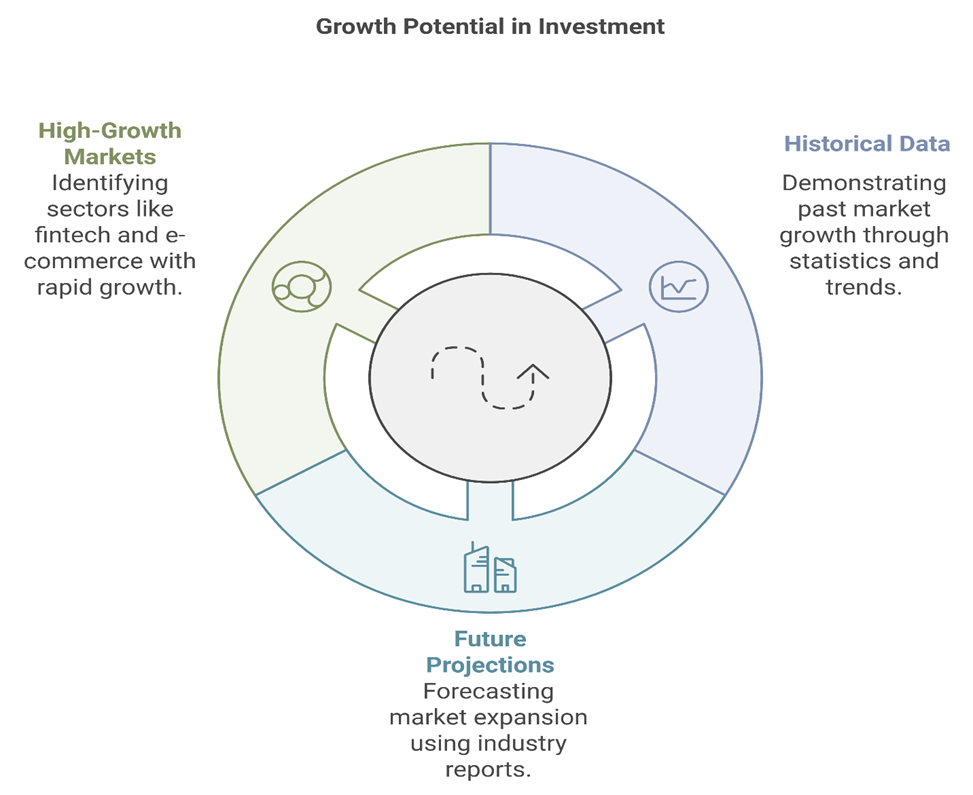

Growth Potential

Investors prioritize markets with clear growth indicators, as this signifies room for increasing revenue. Growth rates offer investors’ confidence that the market will expand, benefiting early entrants.

- How to Demonstrate Growth Potential: Show historical growth data, such as annual growth rates, or project future expansion using industry reports and market research. High-growth markets in the MENA region, like fintech, e-commerce, and healthcare, attract substantial investor interest due to their transformative potential.

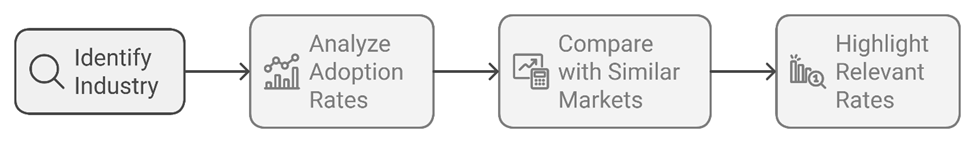

Adoption Rate

The speed at which customers adopt products varies by industry. Highlight adoption rates relevant to your industry.

- How to Demonstrate Adoption Rates: Use comparative adoption data from similar markets. For instance, the rapid uptake of mobile payment solutions in certain MENA countries could be a relevant data point for fintech startups.

B. Competitive Landscape

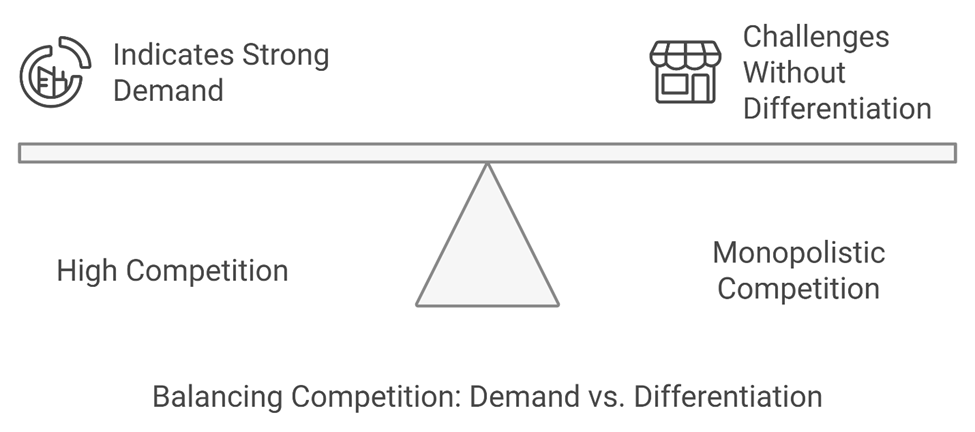

Balanced Competition

Contrary to popular belief, competitive markets aren’t always a drawback. High competition often signals demand. However, excessive or monopolistic competition can be challenging without strong differentiation.

How to Assess Competition: Map your competitors, considering both direct competitors and alternative solutions. Describe how your solution uniquely addresses customer pain points to stand out in a competitive space.

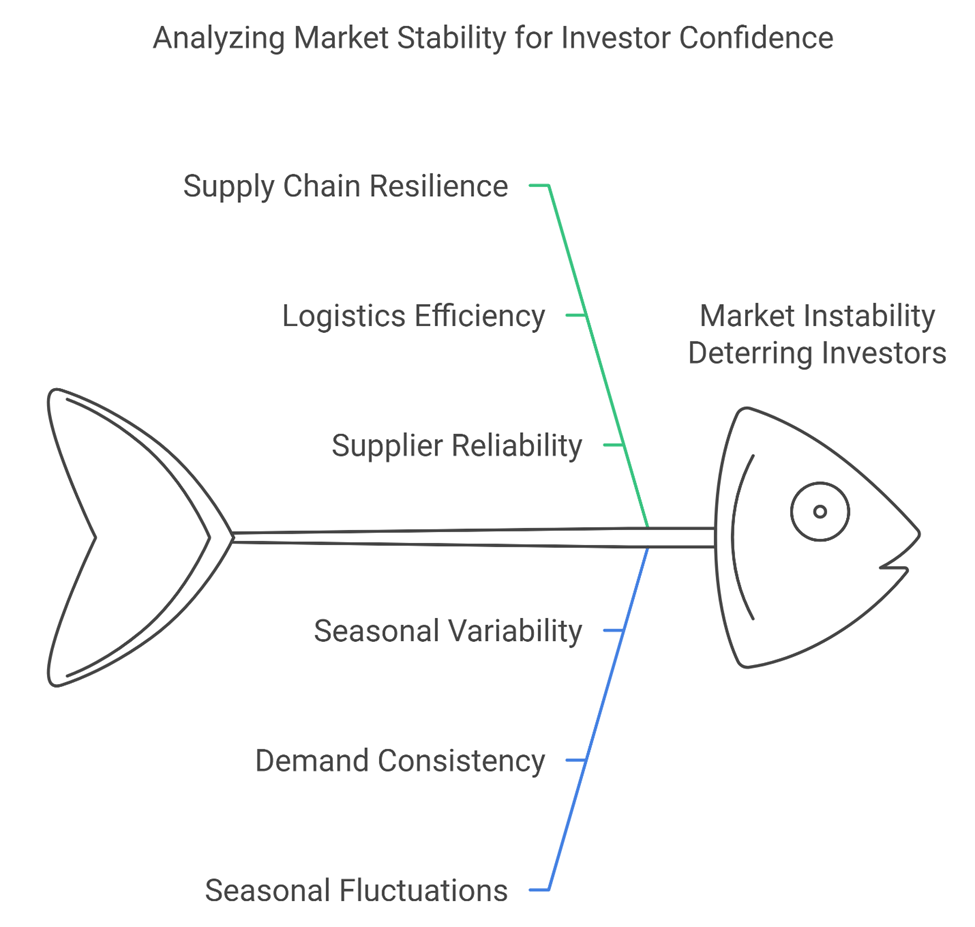

Stability Factors

Market stability, including supply chain resilience and minimal seasonal fluctuations, is a positive indicator. Unstable markets may deter investors due to associated risks.

- How to Demonstrate Stability: Highlight steady demand cycles, such as continuous demand for healthcare or food services. Avoid overstating stability in highly volatile markets, like seasonal tourism, without strategies to manage risks.

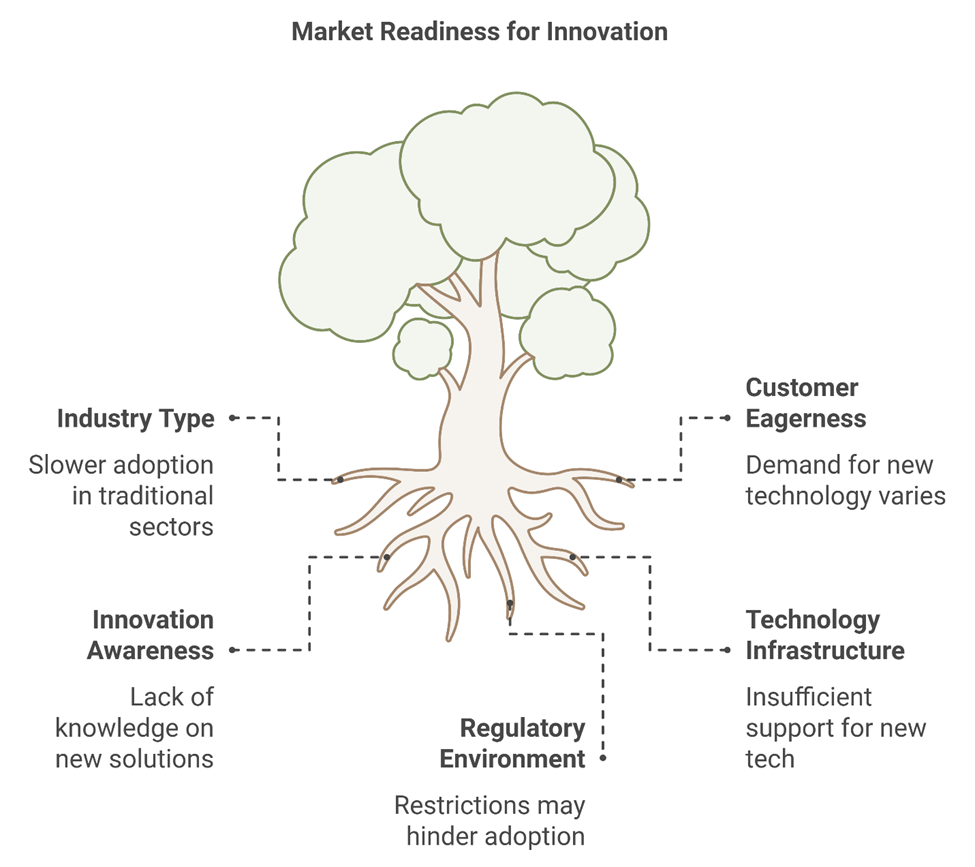

C. Consumer Readiness and Channels to Market

Readiness for New Solutions

Identify whether your market is primed for innovation, especially in sectors where customers are eager to adopt new technology (e.g., consumer electronics). Certain industries, like traditional utilities, may exhibit slower adoption.

- How to Demonstrate Readiness: Reference industry studies on technology adoption rates or present survey data showing consumer openness to new solutions.

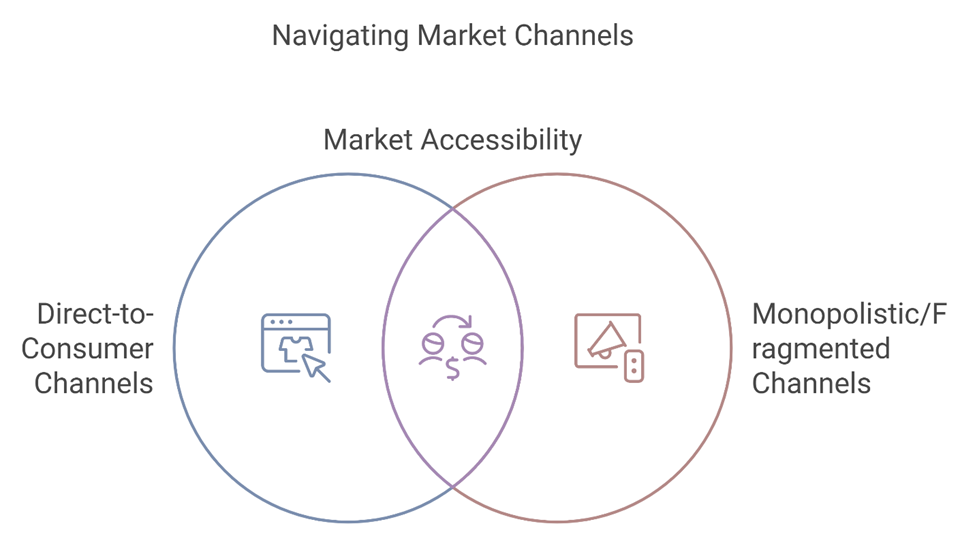

Accessible Channels

The ease with which you can reach customers influences market attractiveness. Direct-to-consumer channels offer high potential, but monopolistic or fragmented channels may present barriers.

- How to Assess Channels: List major channels (e.g., online platforms, retail networks) and identify potential constraints, such as regulatory hurdles or high distribution costs. Consider channels specific to MENA, like the importance of social media and digital marketplaces in reaching younger demographics.

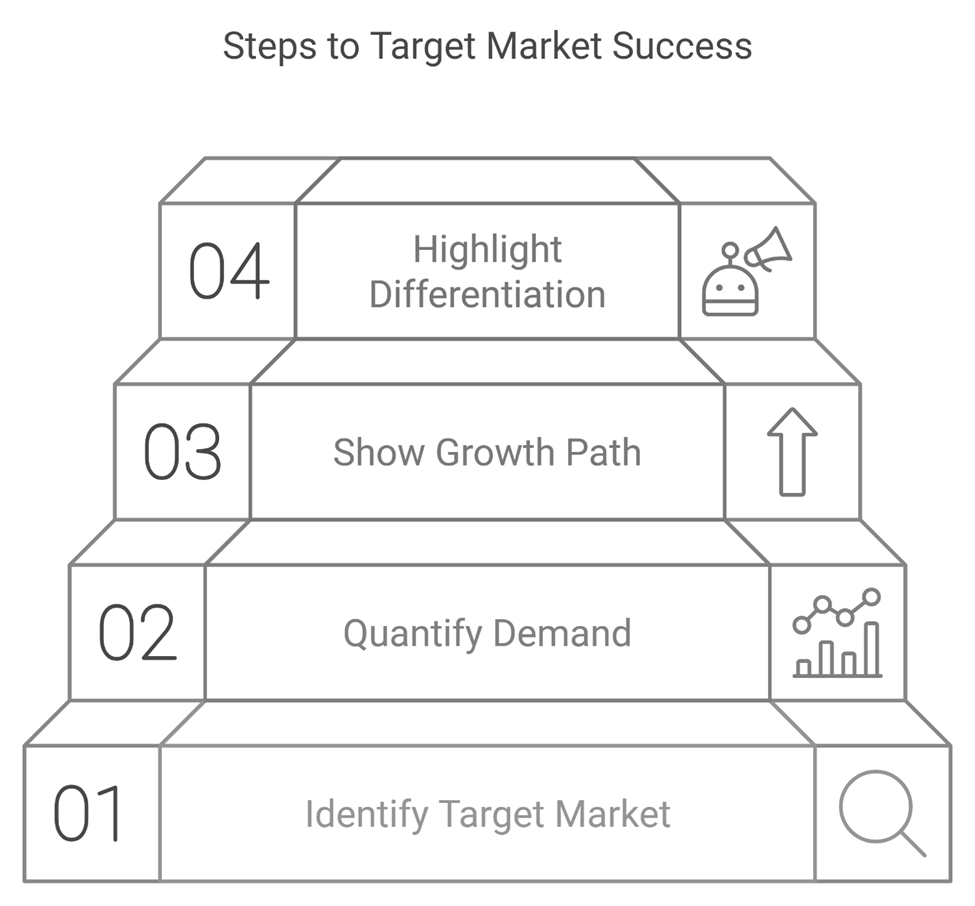

Presenting a Compelling Market Story: A Step-by-Step Guide

Investors respond to data, but they also need a story—a roadmap that illustrates a clear path to market entry and growth. Follow these steps to build a compelling market narrative.

Step 1: Start with a Clear First Target Market

Identify a well-defined segment within your SAM as your “First Target Market.” This initial group should have an urgent need for your solution and be accessible within the near term.

- Example: A MENA-based agritech startup might initially target large farms facing soil degradation in Egypt and Jordan, where soil health is a pressing issue.

Step 2: Quantify Demand and Existing Solutions

Use data to quantify the need, such as the number of potential users, frequency of product use, and price points of existing solutions.

- Example: For a health tech startup, assess the number of healthcare providers needing digital patient management, current software adoption rates, and annual software budget per provider.

Step 3: Show a Growth Path from SOM to SAM and Beyond

Provide a phased approach that takes the company from SOM through SAM to TAM, backed by a realistic timeline and scaling strategy. This demonstrates potential for growth and longevity.

- Example: An initial focus on SOM with a niche, tech-savvy audience in one MENA city could be expanded to larger cities and eventually regional markets, illustrating a clear path to broader market coverage.

Step 4: Highlight Competitive Differentiation

Emphasize how your product uniquely solves problems that competitors overlook. Investors want to see that your solution fills a clear gap rather than merely replicating existing options.

- Example: A startup creating AI-driven language-learning apps could differentiate by focusing on underrepresented languages in the MENA region and providing culturally relevant content.

Conclusion: Communicating Market Attractiveness to Investors

To attract investors, MENA startup founders must offer a convincing narrative that pairs data with vision. By accurately defining TAM, SAM, and SOM, demonstrating growth potential, and illustrating clear differentiation, founders can effectively communicate their market’s attractiveness. A well-structured market narrative not only builds investor confidence but also sets a strong foundation for the startup’s long-term success.

Final Tips for MENA Founders:

- Be Data-Driven: Investors favor startups with clear, data-backed market insights.

- Start Small, Think Big: Begin with a focused target market, showing a path to expand incrementally.

- Leverage Local Context: Showcase market nuances specific to MENA, such as cultural factors or unique consumer needs, to resonate with investors familiar with regional opportunities.

By understanding and clearly presenting market attractiveness, MENA founders can position themselves as valuable, viable investments in the eyes of investors, fostering growth and paving the way for successful scaling.

Add comment