Financial modeling is often perceived as a technical exercise—one that founders undertake primarily to secure funding. However, a financial model that accurately reflects a startup’s business model can do much more than impress investors. It can serve as a strategic tool to validate assumptions, identify weaknesses, and chart a path toward sustainability and growth.

This whitepaper sets the framework for how founders should approach financial modeling as a dynamic and reflective process. It emphasizes the need for alignment between financial projections and the startup’s business model, ensuring that scalability, customer knowledge, value proposition, and partnerships are fully integrated into the process.

Many startups struggle to build financial models that resonate with their underlying business model. Misaligned financial projections can lead to unrealistic expectations, lost investor trust, and operational inefficiencies. This disconnect often stems from a failure to understand how the financial model should encapsulate key aspects of the business, such as scalability, customer dynamics, and value delivery.

Financial Modeling as a Business Tool

A financial model is not just a forecast—it is a strategic representation of how your business will operate and grow. Key benefits of aligning financial models with business models include:

- Investor Communication: Demonstrating a clear understanding of how the business generates value and scales.

- Validation of Assumptions: Testing whether the business’s underlying assumptions hold under various financial scenarios.

- Strategic Planning: Identifying revenue drivers, cost structures, and growth levers.

Key Components of a Reflective Financial Model

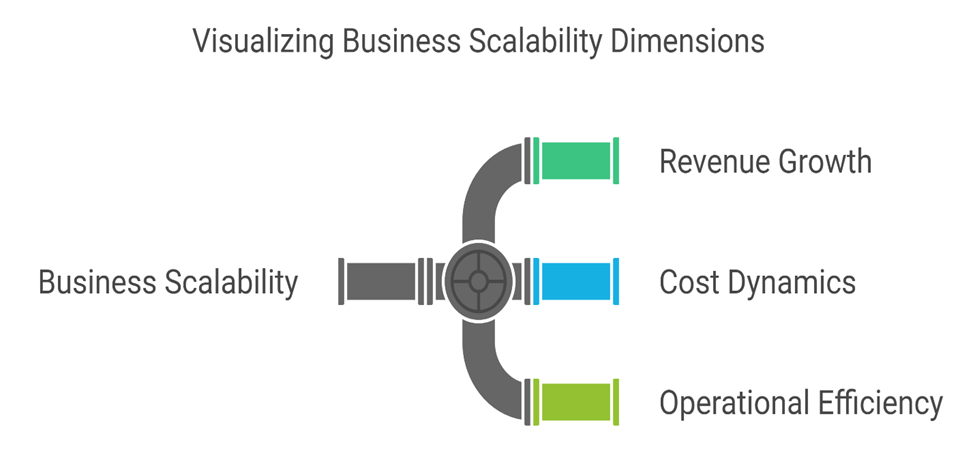

a. Scalability

Your financial model should demonstrate how the business scales over time, capturing:

- Revenue Growth: How revenue increases with customer acquisition.

- Cost Dynamics: Fixed vs. variable costs and their behavior at scale.

- Operational Efficiency: Economies of scale in production, distribution, or service delivery.

Tips for Incorporation:

- Use unit economics (e.g., CAC, LTV) to show profitability at scale.

- Highlight scalability in revenue streams—subscription-based models, for example, should show churn rates and customer retention strategies.

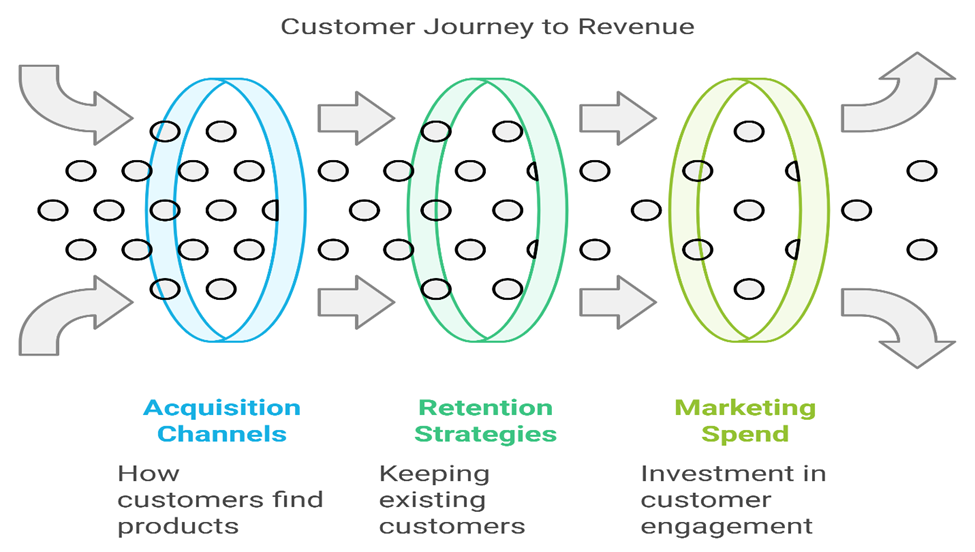

b. Deep Knowledge of Customers

Understanding your customers is essential to both your business and financial models. This includes:

- Customer Segmentation: Identifying who your customers are and how they differ.

- Acquisition Channels: How customers discover and engage with your product/service.

- Retention Strategies: The financial impact of retaining vs. acquiring new customers.

Tips for Incorporation:

- Include detailed assumptions for customer acquisition and retention costs.

- Show clear relationships between marketing spend and revenue generation.

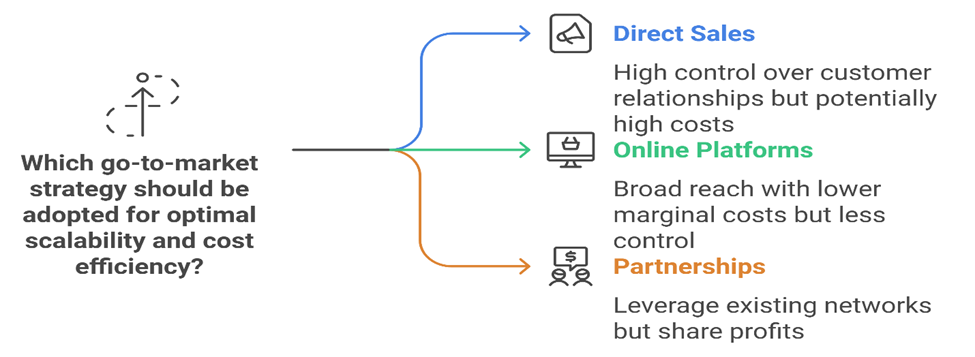

c. Customer Reach Strategies

How you reach your customers affects both your costs and your ability to scale. A good financial model should reflect your go-to-market strategy, including:

- Channels: Direct sales, online platforms, partnerships, etc.

- Costs of Acquisition: Marketing campaigns, partnerships, or other outreach initiatives.

Tips for Incorporation:

- Break down acquisition costs by channel.

- Model scenarios for different channel mixes to show adaptability.

d. Partnerships

Strong partnerships can amplify your startup’s reach and reduce costs. Your financial model should capture the impact of these collaborations.

Tips for Incorporation:

- Include revenue-sharing agreements, if applicable.

- Highlight cost savings or enhanced distribution from partnerships.

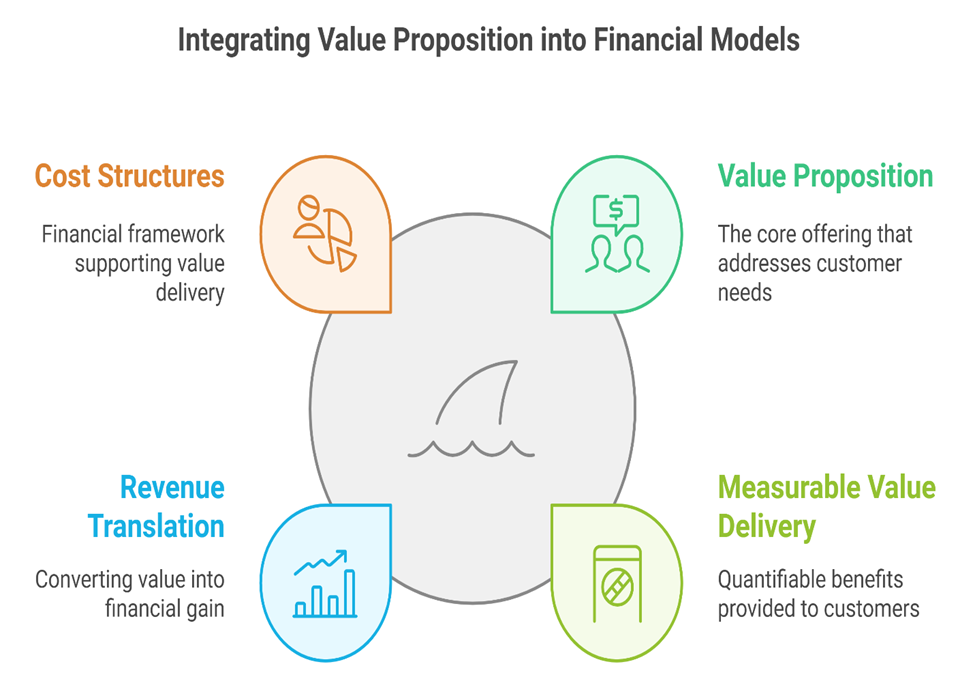

e. Value Proposition

At the heart of every business model is its value proposition—how it solves problems or fulfills needs for its customers. A financial model should clearly illustrate how the business delivers value in ways that are measurable.

Tips for Incorporation:

- Quantify the impact of your value proposition, such as time saved, costs reduced, or quality improved for customers.

- Reflect how delivering this value translates to revenue and cost structures.

Tips for Building a Strong Financial Model

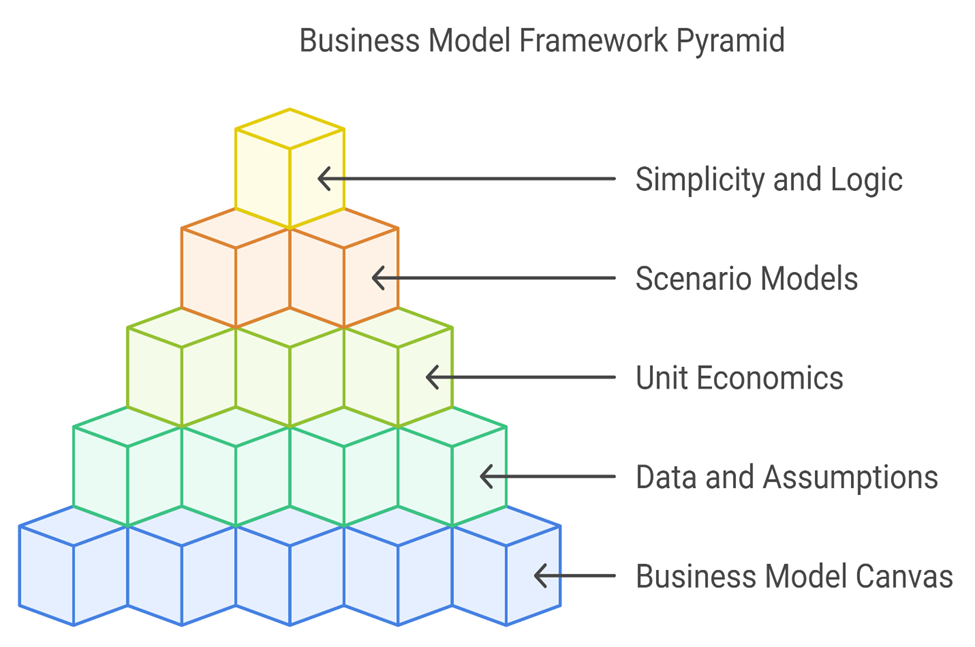

1. Start with a Clear Business Model Canvas

Before diving into numbers, map out your business model using frameworks like the Business Model Canvas. Define key components such as:

- Customer Segments

- Value Propositions

- Channels

- Revenue Streams

2. Leverage Data and Assumptions

- Use historical data (if available) or market benchmarks to inform your assumptions.

- Clearly document assumptions to facilitate transparent discussions with investors.

3. Focus on Unit Economics

Investors care about the fundamentals of your business. Show metrics like:

- Customer Acquisition Cost (CAC)

- Customer Lifetime Value (LTV)

- Gross Margins

4. Build Scenario Models

- Prepare best-case, worst-case, and base-case scenarios to show adaptability.

- Highlight how your business performs under different growth or market conditions.

5. Keep it Simple and Logical

- Avoid overly complex models that are difficult to explain or understand.

- Ensure the model’s logic is clear and flows logically from assumptions to results.

Case Studies

Case Study: SaaS Startup

A SaaS startup aligned its financial model with its business model by:

- Showing a detailed churn analysis alongside subscription revenue projections.

- Highlighting the impact of customer onboarding strategies on retention.

Result: The financial model demonstrated long-term profitability, leading to a successful funding round.

Case Study: Marketplace Business

A marketplace startup showcased how partnerships with suppliers reduced costs and increased scalability:

- Modeled revenue-sharing agreements.

- Included cost savings from bulk purchasing.

Result: Investors appreciated the clarity of the business’s operational efficiency.

Conclusion

Financial modeling is a reflection of your startup’s business model. A well-aligned financial model serves as both a strategic roadmap and a powerful communication tool. By focusing on scalability, customer understanding, partnership dynamics, and value delivery, founders can create models that not only attract investors but also guide sustainable growth.

Startups that view financial modeling as an integral part of their strategy, rather than a standalone exercise, are better positioned to succeed.

🚀 Ready to fuel your startup’s growth? Join multiples.cc today! Gain access to valuable tools, connect with investors, and get personalized support to help you succeed on your fundraising journey. Sign up now and take the next step toward securing the resources your startup needs to thrive!

Thanks.. informative piece @Abdelrhman.