Introduction

Financial modeling is a vital tool for tech startups, enabling founders to forecast future performance, evaluate funding requirements, and present a compelling case to investors. A robust financial model provides clarity on how funds will be utilized and their anticipated impact on the business. This white paper aims to simplify the process of financial modeling, ensuring it is accessible to early-stage entrepreneurs while laying a foundation for more complex analysis as the startup grows. Don’t forget to download your free Financial Projections Template from here after reading the article

Objectives and Five-Year Projections

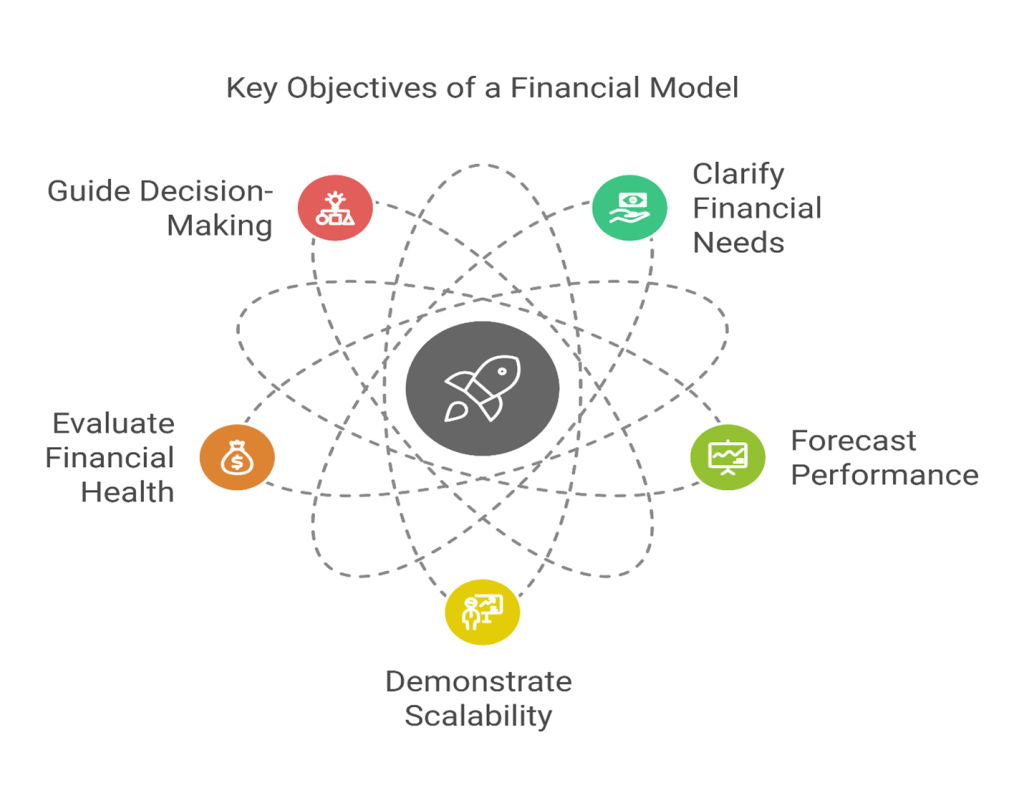

A financial model for a tech startup should aim to:

- Clarify Financial Needs: Define the funding amount required and specify how it will be utilized.

- Forecast Performance: Provide a clear projection of revenue, expenses, and profitability over five years.

- Demonstrate Scalability: Show how customer acquisition and revenue streams will grow with funding.

- Evaluate Financial Health: Assess the startup’s financial stability through key indicators like ROI, solvency, and free cash flow (FCFF).

- Guide Decision-Making: Offer a data-driven basis for strategic decisions.

Steps to Build a Simple Financial Model

1. Assumptions

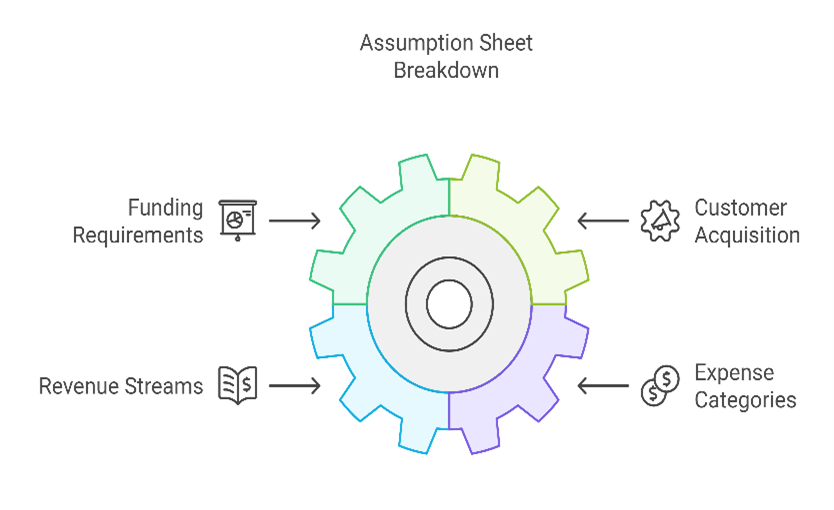

The foundation of any financial model is a set of realistic assumptions based on market research and strategic goals.

- Funding Requirements:

Example: Assume a total funding requirement of $1 million, allocated as:

- Marketing (20%): $200,000

- R&D (30%): $300,000

- Team Salaries (35%): $350,000

- Operations (15%): $150,000

- Customer Acquisition:

Example: Assume customers are acquired through digital marketing (75%) and a sales team (25%), with a cost-per-acquisition (CPA) of $50.

- Revenue Streams:

Example: Revenue generated from monthly subscription fees, freemium upgrades, and one-time product purchases.

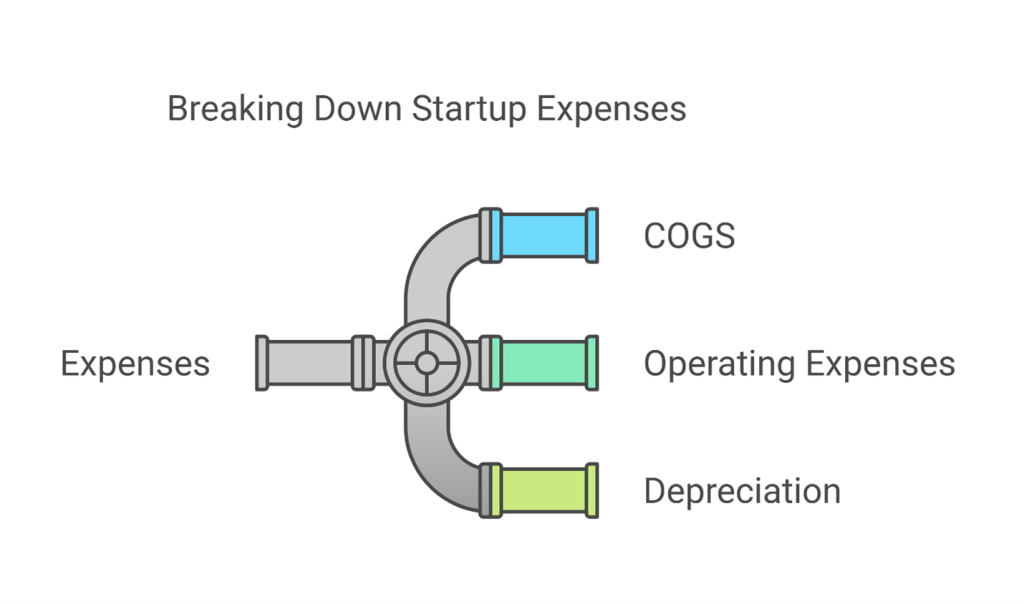

- Expense Categories:

- Cost of Goods Sold (COGS): Variable costs associated with delivering the service.

- Operating Expenses: Fixed costs such as rent, utilities, and software licenses.

- Depreciation: Annual depreciation on assets such as equipment or software.

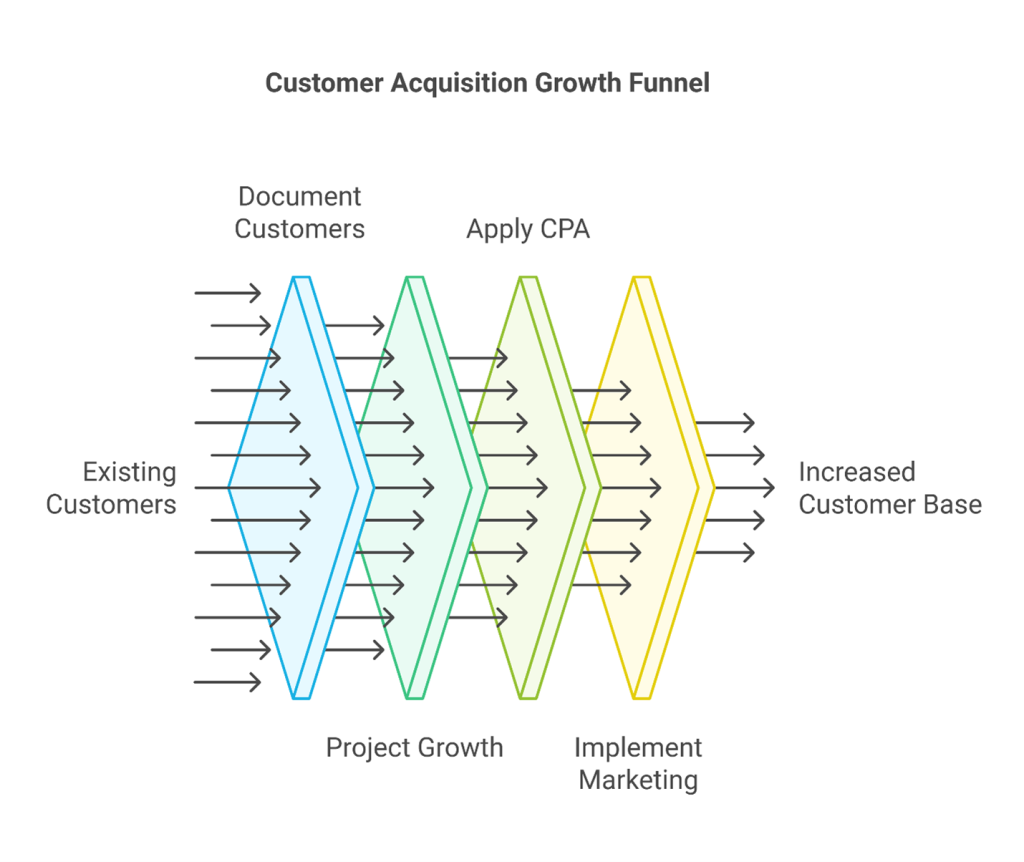

2. Customer Acquisition

Start by documenting your existing customers and project monthly acquisition growth based on your CPA and marketing efforts.

Example:

- Initial customer base: 100 users.

- Monthly acquisition: 50 new users.

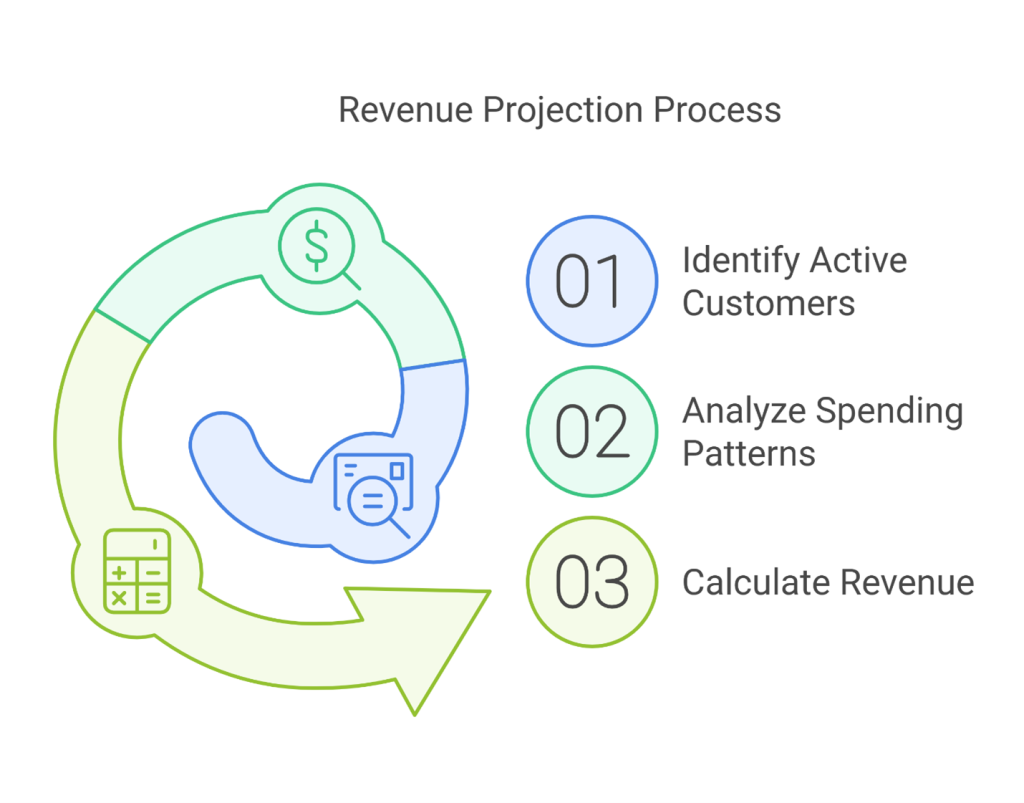

3. Revenue Streams

Map revenue based on active customers and their spending patterns.

Example:

- Subscription fee: $20/month.

- Revenue projection = Active Monthly customers × $20.

4. Expenses

List all major expenses, including:

- COGS: Variable costs, e.g., cloud hosting fees.

- Operating Expenses: Salaries, marketing, rent.

- Depreciation: Gradual reduction in asset value.

5. Financial Statements

Focus initially on the income statement:

- Revenue: Total income from all revenue streams.

- Expenses: All outflows, including COGS, operating costs, and depreciation.

- Profit/Loss: Revenue minus expenses.

6. Valuation Sheet

Use valuation techniques to estimate your startup’s worth Like:

- VC Multiples Method: Apply industry-specific revenue multiples.

Advanced Financial Modeling Components

· Payroll Sheet

Detail team structure, salaries, and projected hires over five years.

· Capital Expenditures (CapEx)

Projected investment in assets such as software or hardware.

· Depreciation and Amortization

Track the decline in asset value over time.

· Full Financial Statements

Include income statements, balance sheets, and cash flow statements.

· Financial Indicators

- Free Cash Flow to Firm (FCFF)

- Return on Investment (ROI)

- Solvency Ratios

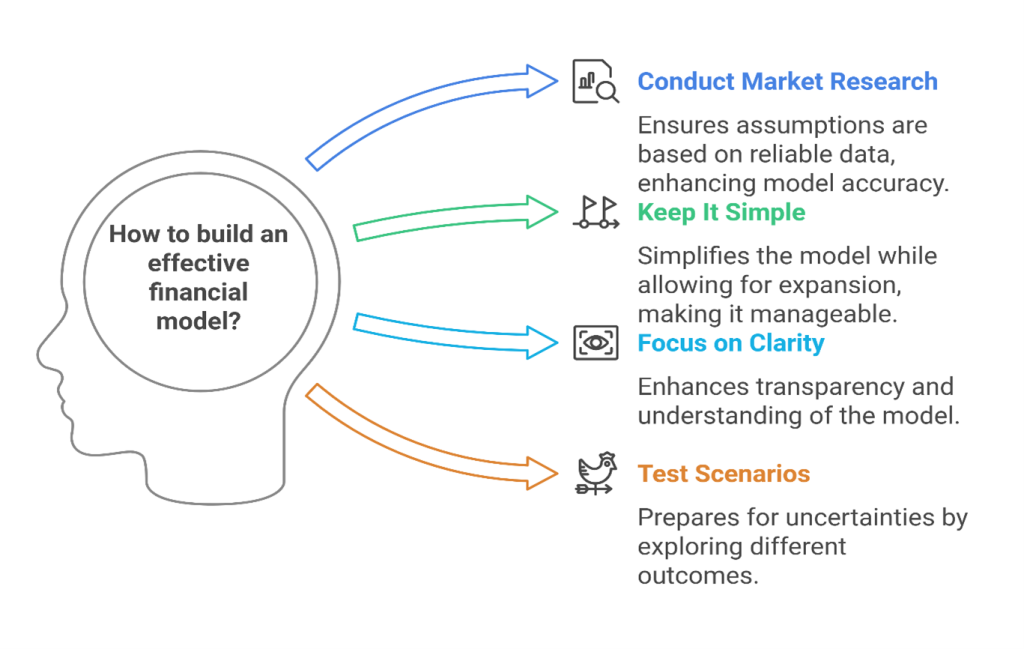

Guidelines for Building an Effective Financial Model

- Conduct Thorough Market Research:

Base your assumptions on reliable data about your market, competitors, and customer behavior.

- Keep It Simple Yet Detailed:

Start with straightforward assumptions and expand as needed.

- Focus on Clarity:

Ensure all calculations and assumptions are transparent and easy to understand.

- Test Scenarios:

Create best-case, worst-case, and base-case scenarios to prepare for uncertainties.

- Align with Strategic Goals:

Ensure your financial model reflects the startup’s mission and objectives.

- Communicate Impact to Investors:

Demonstrate how their funding will drive growth, improve scalability, and yield returns.

Conclusion

Building a financial model is an indispensable step for any tech startup seeking to understand its financial trajectory and attract investor interest. By following a structured approach—starting with simple assumptions and gradually incorporating more complexity—you can create a model that is both insightful and persuasive. With diligent market research, clear documentation, and scenario analysis, your financial model will serve as a powerful tool for decision-making and securing investment.

🚀 Ready to fuel your startup’s growth? Join multiples.cc today! Gain access to valuable tools, connect with investors, and get personalized support to help you succeed on your fundraising journey. Sign up now and take the next step toward securing the resources your startup needs to thrive!

Add comment